As a fully compliant payroll provider, ePayMe is transparent about the way we work and the amounts we charge you for processing your pay. We are always happy to answer any queries you may have, but for your convenience here are some of the questions that we are most often asked.

Service and Margin

AdvanceMe Request – £15.00

Confirmation of Employment Letter – £25.00

Copy Payslips (per tax year) – £15.00

Duplicate Documentation – £10.00

Email Payslips &/or Pay Summaries [each] – £2.00

Expediting Payments – £50.00

HMG Instructed Pay Adjustments – £5.00

Minimum Charge – £7.50

Non-Supply of Documentation required by ePayMe – £10.00

Payments Outside of Regular Schedule – £25.00

References/Completion of Forms – £20.00

Registration Outside Agency Assignment – £50.00

Reprocessing Payroll/Reversal – £30.00

Standard Margin – Fortnightly – £70.00*

Standard Margin – Monthly – £100.00*

Standard Margin – Weekly – £35.00*

Statement/Certificate of Earnings – £15.00

Statutory/ad-hoc – £30

Telephone Support – 10.00

*Included in our Standard Margins only are the following services: processing of holiday pay inclusive in margins, 3 different options for the receipt of your payslips inclusive in margins, statutory processing, 1 AdvanceMe request per month inclusive in margin, insurances and 1 expedited payment per month (weekly) inclusive in margin. Please note if you are on reduced margin from our standard margin stated above, a margin will apply to all other services, payments processed and insurances will be displayed separately on your payslip. Should you wish to upgrade, please speak with our Customer Service Department by emailing admin@epayme.co.uk with your request or complete the contact us form.

You do the work and the agency or end client pays us an agency rate, the contract rate, to cover both payment to you for the work you have done and all the costs related to your employment, such as employer’s NIC, Apprenticeship Levy (AL) and the employer’s pensions auto-enrolment contribution. This rate is, therefore, higher than you would expect to get if you were paid PAYE, to allow for these additional costs. At this stage, the money we receive represents the gross income of the department of the umbrella company that you represent. It has not yet become your money.

We make provision for your basic pay at National Minimum Wage, a provision for the Employer’s National Insurance, (AL) and pensions auto-enrolment contributions relating to all payments that are to be made to you. We set aside provision for your working time directive and we set aside provision to reimburse you. What is left represents the profit of your department.

Your basic pay, any loans we may make in respect of your working time directive together add up to your total taxable pay and are shown as such on your payslip. This is paid, subject to PAYE and Employee’s National Insurance, Tax, AL and pensions auto-enrolment contributions.

If you have opted for the portal (additional margin uplift charged) your payslip will available on your Portal at any time, otherwise they will be emailed or posted (as chosen by you, once your compliance set up has been completed). Please note for postal payslips or the portal, there will be additional charges. Your payslip will detail deductions and your net pay.

For details of what appears on your payslip, see the next question.

The notes below provide further explanation of how your pay is worked out.

Company Receipts 1

minus

Company Deductions 2

equals

Gross taxable pay

Shown on your payslip as

‘Paid to Employee’

Gross taxable pay

minus

Employee Deductions 3

equals

Net pay

The amount paid into your

bank account on pay day

1 Company Receipts

This is the total amount you earned, calculated as units of time multiplied by your Agency Rate (or Assignment Rate).

The Agency Rate (or Assignment Rate) is made up of your basic wage for hours worked, plus an extra ‘uplift’ to compensate for the Agency Worker Deductions that are required by law. These deductions may include Employer’s National Insurance, the Apprenticeship Levy, Insurance and Pension.

2 Company Deductions

Agency Worker Deductions: These are payments made directly to HMRC. Your agency rate includes a special ‘uplift ‘ to compensate for these deductions.

Expenses: With some types of work you can submit allowable expenses. These are not repayable but they can reduce your tax bill. Your agency can advise on this.

Margin: This is the fee we charge for processing your pay. It’s the only cost to you for using ePayMe.

Working Time Directive: The EU Working Time Directive requires us to retain some of your pay for use when you wish to take holiday. Requested holiday pay appears on your payslip as Holiday Pay and is subject to tax. You can opt of this scheme.

Employee Reward Scheme: ePayMe offers a reward scheme through our pension provider, Smart Pensions

3 Employee Deductions

Tax: Our system links directly to HMRC (‘Real Time Information’). This ensures your tax code is correct and you will always pay the right amount of tax.

National Insurance: This is Employee’s National Insurance and as with tax, the amount you pay is set by HMRC. Note that you also pay Employer’s National Insurance but this is covered by your agency uplift and is not a cost to you.

Smart Pension: Under UK law, you will be automatically enrolled into a workplace pension scheme after being paid for 12 weeks. We use Smart Pension for this. Once enrolled, you will get a welcome pack from Smart Pension, explaining how the pension works and how you can opt out if you so wish.

Should the assignment have ended and no further pay has been processed after a 12-week period, we will automatically make you inactive within our system and this processes a P45 to HMRC so that if you are working elsewhere, your Tax Code is not affected. If, however, circumstances change and work is found, we can easily reactivate you.

Please note that this does not cancel the Contract of Employment as long as a valid Assignment Schedule is provided. Assignment Schedules are required at all times for all assignments and should be forwarded to us.

Due to Government regulation, you accrue a holiday pay entitlement based on your average working hours. As your Contract makes clear, your pay includes an element for holiday pay and this is effectively saved up and paid to you only when you elect to take a period of time as paid holiday.

This holiday pay can be paid to you at any point which you nominate as paid holiday throughout the Tax year. It’s simple: just send our team an email to holiday@epayme.co.uk requesting the amount of holiday you wish to be paid and the date you want it paid to you and we can tell you what that will equate to in terms of the paid holiday entitlement which you have accrued. If you have accrued enough, you can choose to take paid holiday on that basis.

Please note that we need one month’s notice. The money paid is also subject to deductions and paid holiday must be requested before the end of the current Tax Year, which is also the end of our holiday year. Entitlement is to be paid leave accrued in that year and please note that any payment for it will otherwise be lost.

- set up and manage your own Limited Company (This option is not available to all Contractors. Please check your status with your Agency).

- use the services of an Outsourced Payroll company like ePayMe, or

- work through your recruitment agency.

Whichever way you choose, there are both National Insurance contributions, one way or another.

Please note:

THE DAILY OR HOURLY RATE YOU ARE GIVEN IS YOUR CONTRACT RATE (ASSIGNMENT RATE), NOT YOUR SALARY UNTIL EMPLOYERS NI, APPRENTICESHIP LEVY AND OTHER AGENCY WORKER DEDUCTIONS IN ADDITION TO THE OUTSOURCED PAYROLL COMPANY MARGINS ARE DEDUCTED FROM THE CONTRACT RATE. i.e; THE MONIES THEY RECEIVE FOR THE WORK UNDERTAKEN.

All Outsourced Payroll companies, as employers, have a legal obligation to pay Employer’s National Insurance contributions and the Apprenticeship Levy (AL) to HMRC. These contributions are made from the funds received from the recruitment agency/client with whom the Outsourced Payroll Company will have a business to business contract; the employment costs must be paid from these funds before the salary is available to the contractor, they will also deduct their margin from the contract value.

You will work with the Outsourced Payroll company under an over-arching contract of employment and your salary will be subject to Tax and Employee’s National insurance contributions. Your salary is calculated as the contract value, less the Outsourced Payroll company margin (fee), less the amount payable to HMRC for Employer’s NI and the AL.

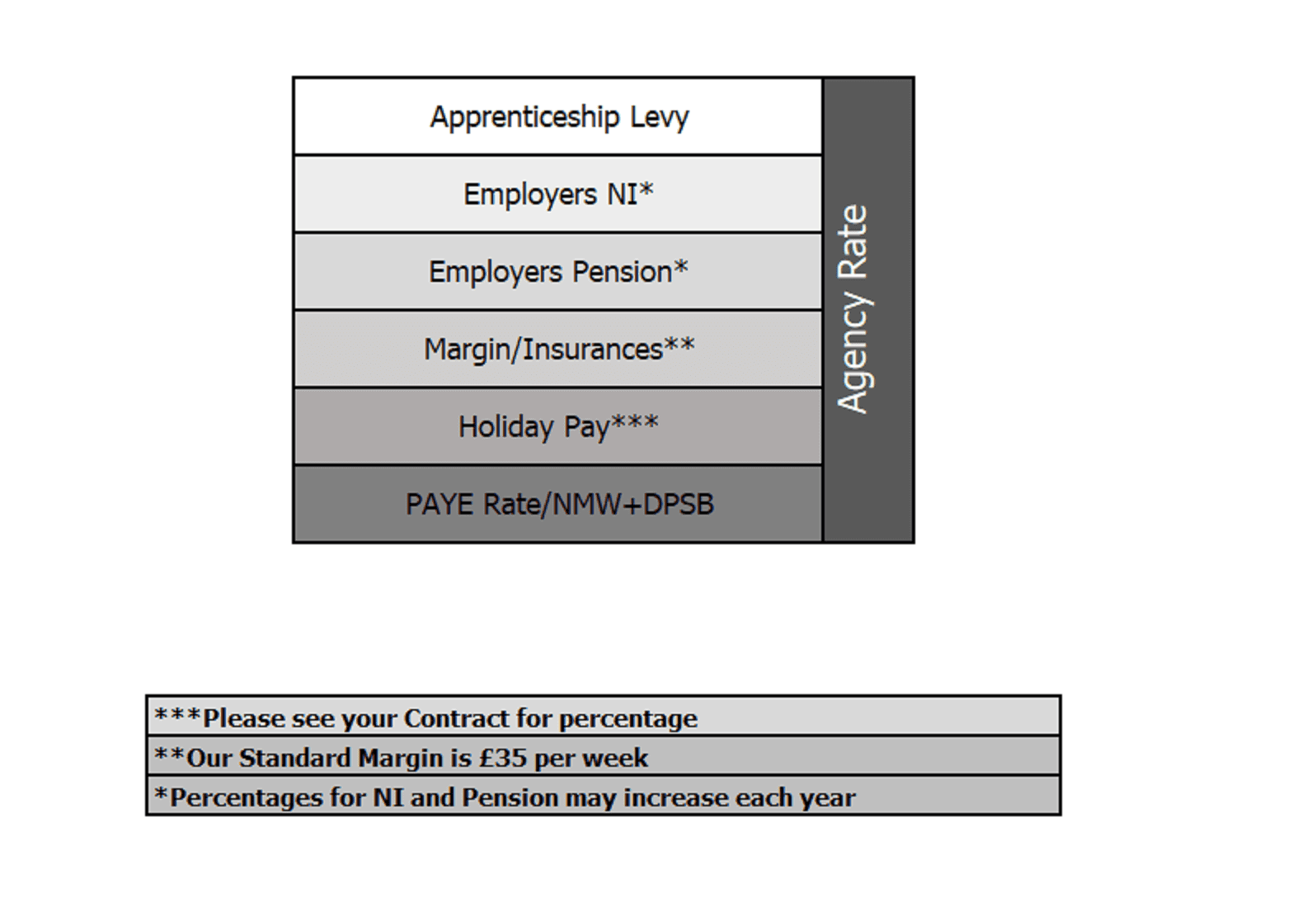

These are some of the items that make up your agency rate:

*These percentages may vary and A Levy is retained with an additional amount for the refund of Holiday Pay.

Accumulative Tax Codes

1257L – This is the most common tax code for the tax year. You can locate your tax code on your payslip’s which will be shown as 1257L and will not include an X. It means your tax is calculated on your overall year-to-date earnings (including earnings from previous positions within the current tax year)

The tax due on each payment is determined after taking into account any tax you have already paid in this year and how much of your accumulated allowance you have already used.

This has the advantage of meaning any unused allowance is carried forward to future weeks. This could arise after a gap without pay, if you start working later in the year or if you have earnings less than your allowance.

Non Accumulative Tax Codes (X OR 1)

If you see an X or a 1 at the end of your tax code, it means your tax is only being calculated on your earnings for that pay period.

Which means your allowance is not being taking into consideration. This is normally used if you have other income, if you have not provided us with a P45 (if you have a P45 from your previous employer please email it to admin@epayme.co.uk) or you have been in receipt of any state benefits such as income support or job seekers allowance.

What this means to you and your pay?

Example: On an accumulative tax code, if you are paid weekly, your allowance is £240 per week you pay tax. Earnings above this amount are then subject to tax, if you then had 2 weeks off work your free pay allowance would then be carried forward. Which means when you return to work on the 3rd week your tax allowance would be higher and depending on your weekly income may mean you do not pay any tax that week or even receive a tax rebate!

Example: On a non-accumulative tax code on a weekly pay scheme, your allowance still remains at £240 however any previous earnings are not taken into consideration, which means your free pay allowance is not carried forward when you take time off or any rebates generated.

I am concerned, am I on the wrong tax code?

If you believe you are on the wrong tax code for your circumstances there are simple, steps to follow to ensure you are on the correct tax code:

If you have a P45 dated within the last 8 weeks please forward this to our dedicated Customer Service Team who can update your tax information accordingly admin@epayme.co.uk

Should you not be in receipt of a P45 we would recommend you contact HMRC on 0300 200 3300 and provide the following information

• Our PAYE reference number 475/SB61958

• Employers name – ePayMe Ltd

• Your national insurance number

If your tax code then needs to be updated, HMRC will send us a notification to amend your tax code, which we will change immediately.