From 6 April 2015, many employment intermediaries (Recruitment Agencies) are accountable for new quarterly reporting rules.

From 6 April 2015, many employment intermediaries (Recruitment Agencies) are accountable for new quarterly reporting rules.

Intermediaries (Recruitment Agencies) are required to return details of all workers they place with clients where Pay As You Earn (PAYE) is not operated on the workers’ payments. The Report (or reports in most cases) must be sent to HM Revenue and Customs (HMRC) once every 3 months, before the required deadline.

As a recruitment agency paying contractors outside PAYE you are responsible for sending the required report to HM Revenue & Customs.

What are the agencies required to do? HM Revenue & Customs requires the following information to be reported by the agency for each worker:

- You must select the reason why you didn’t operate PAYE on the workers payments from these options: A: Self-employed B: Partnership C: Limited liability partnership D: Limited company including personal service companies E: Non-UK engagement F: Another party operated PAYE on the worker’s payments

- The workers personal details;

- Start date of work with client;

- End date of work with client (if there is such a date);

- The full name or trading name and address of who the intermediary paid for the worker’s services (this may be the worker’s company or partnership);

- Companies House registration number (but only if the worker was engaged to do the work through a limited company – option D on the HM Revenue & Customs list)

HMRC have created a template file that you must use to create your report. This can be found by following the link below:

https://www.gov.uk/government/publications/employment-intermediaries-report-template

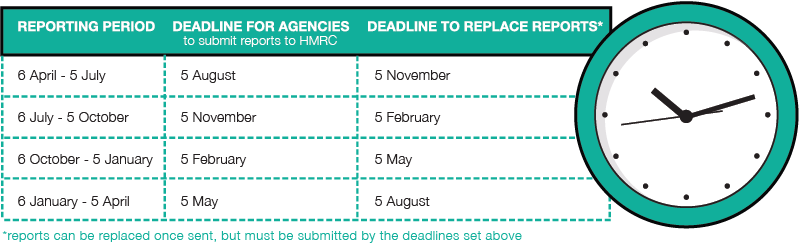

All reports are required to be submitted in line with the below dates, failure to do so can lead to costly fines.

With automatic penalties introduced if your report is received by HM Revenue & Customs late, incomplete or incorrect, it is vital that it is done correctly. Penalties are based on the number of offences in a 12-month period. £250 – First offence, £500 – Second offence, £1000 – Third offence and later offences.

If there are 12 months or more between offences, you will only be charged £250 for the first offence in the new 12-month period.

What does this all mean for you the agency? Where an umbrella company such as ePayMe has operated PAYE on the payments made to the worker for their services, you as an agency are not legally obligated to inform HM Revenue & Customs with regards to the payment amount. However it is the obligation of the agency to report the worker’s identity details, payroll (umbrella) company name, registered address, registration numbers and the start/end dates of the assignment being undertaken.

Since the HM Revenue & Customs Intermediary Reporting was first announced we have seen some changes take place, which is inevitable when a new system is introduced. Whilst we will continue to inform you of updates, please ensure that you visit the HM Revenue & Customs website (link below) regularly, so you know you are dealing with the most relevant and up to date information.

CLICK HERE TO OPEN PDF VERSION

w: www.epayme.co.uk t: 0800 622 6119 e: info@epayme.co.uk

![]()